Content

Using an accounting app will save you time and money and help you keep track of how much money is coming in and how much is going out. That’s why monthly bookkeeping for contractors is so helpful. It better tracks the money you have coming in and the money you have going out. Using monthly bookkeeping, you bookkeeping for independent contractors can gain invaluable insight into what expenses can be written as deductions when you file your tax return. You and your bookkeeper can work together to simplify the monthly overview of your finances as an independent contractor. But what is bookkeeping and why should contractors care so much about it?

You’ll find all the assistance you need in the knowledge base, but FreeAgent has a lot more help to offer. There’s a weekly onboarding webinar running every Thursday. If you like the format, watch the 15-minute presentation and follow up with your questions; if you can’t make it, you can also see the recorded version. The user interface is simple and appealing, without a lot of sparkle or frills. Creating invoices or other documents follows a step-by-step process, breaking down the big tasks into smaller ones, which should feel more organized than with many other apps. FreeAgent feels more serious, like it’s aimed at folks who are more established in their careers, handling larger projects and bigger financial decisions.

FOR YOUR INDEPENDENT CONTRACTOR

Keeping accurate financial records is the best way to account for your tax liability. Failing to file expenses and profit will ultimately lead you to be audited by the IRS. If you’re an independent contractor who needs complete accounting support, you’ll want to check out Bench. It’s an accountant and accounting app in one with two packages available.

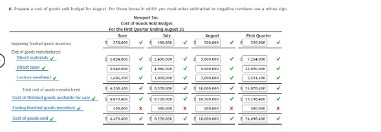

Before classifying a worker, consider how much control you have over a worker in the three above categories. The paperwork previewed in the image will provide the structure and language for an Accountant/Bookkeeper to solidify a Client job. It may be downloaded by clicking any of the buttons in the preview image’s caption area or through the links above.

Smart bookkeeping. Powered by professionals. Backed by technology.

Above all else, the most significant benefit of utilizing accounting software is creating accuracy and order within your business. Many new small business owners will start by entering all of their bookkeeping on an Excel spreadsheet. The manual labor of entering data into Excel is likely to bring mistakes. The software will automatically take your invoices, payments received, payments returned, and expenses to organize your books. I signed up for each of these freelance accounting software solutions and created a series of invoices, expenses, projects, and time sheets to test how they work.

But if you don’t have a record of your expenses, Uncle Sam is happy to tax you based on the larger amount. Would you prefer to pay taxes on a lot or on not as much? Don’t waste your time finding a bookkeeper and a tax preparer.

Stay up to date on the latest accounting tips and training

For freelancers or small businesses, one may claim that any purchase under $1000 can be an Expense instead of a Fixed Asset. Although customer service reviews are mostly positive, some FreshBooks users report that they’ve been double charged, and customer support is not always responsive to these issues. Saving money and paying estimated taxes in advance will help set you up for a more promising future. This month can be a lot different than the same month last year.

The practice of reconciliation will help you ensure that every transaction matches your accounts. It is also a great way to prepare yourself for tax season. Having organized books will also help your business ensure that every invoice is sent out on time, that your accounts receivable is not going unpaid, and that you pay your credit card bills.

What is an independent contractor?

We chose QuickBooks because we believe it has the most features, ease-of-use, and pricing that most independent contractors will need. But every contractor is different, so one of the other accounting apps on our list may fit your needs better. You’ll get monthly financial reports and can rest easy knowing the books are taken care of. Bench doesn’t include accounting, but it does provide the reports and support you need for your accountant to take care of things come tax day. Zoho made our pick as best accounting software for part-time contractors because its basic, free version provides everything most contractors will need–all at no cost.

- Independent contractor payments are reviewed by Tax Services for final approval.

- A checklist has been supplied to the first article (“I. Services”) allowing you to define the services the Accountant must supply to fulfill this agreement.

- The biggest pro of having independent contractors is having recourse if the work is shoddy, as well as not having to pay payroll taxes.

- Accounting software will make it easier to do so with the ease of invoicing.

4Corner Business Services is Denver’s answer to bookkeeping, accounting, and business advisory services. We offer expert accounting, tax, and organizational services to small and large businesses across the Denver metro area. As an English-Spanish bilingual firm, we offer accessible, accurate, and timely advice for all your business needs. Whether you’re looking for accounting & bookkeeping services, organizational support, or business consulting services, 4Corner is here to help you grow as an independent contractor. Additionally, independent contractors don’t have to go through as much training and onboarding as payrolled employees. Contractors are commonly hired for a specific service, so the bulk of what they do is completing assignments and tasks in relation to the service they were hired for.

Contractor Bookkeeping Services

The person ghosted me, so I had to show up at her front door and demand the records back. After that incident, I reached out to my insurance agent to find out if my Errors and Omissions (E&O) insurance covered this risk. Independent contractor payments https://kelleysbookkeeping.com/ are reviewed by Tax Services for final approval. Information on what is required for final approval of these vouchers is included below. You might use an independent contractor to perform work or complete a specific project at your business.

- Whether you’re a business owner with multiple team members or are a sole proprietor, we specialize in servicing independent contractors with all of your accounting needs.

- The next article shall discuss how the Client will treat money the Accountant pays out of pocket in order to successfully complete the tasks he or she is being commissioned to perform.

- Just start tracking, start organizing, and let someone take it from there.

- As an independent contractor, you tend to dread the upcoming tax season; it usually means days of drowning in itemized receipts.

- Doordash gives you no pay stub, neither do any of the others.